First Class Info About How To Apply For Homestead In Florida

Swap your primary residence and second home without selling.

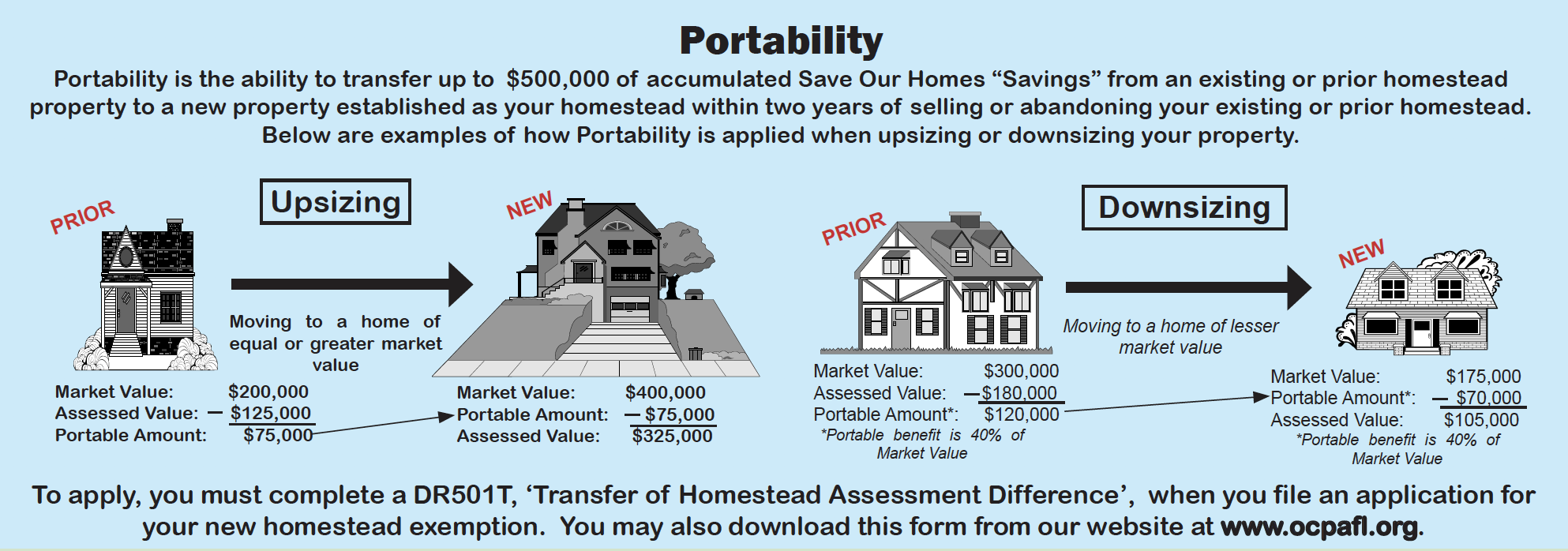

How to apply for homestead in florida. Homestead exemption, save our homes assessment limitation, and portability transfer. Our online exemption application login process has changed as of february 1, 2021. Application due to property appraiser by march 1.

Homeowners may claim up to a $50,000 exemption on their primary residence. ( fl stat 196.011 (11) ). Click here to begin the online homestead application process and you will automatically be prompted to print and complete a portability application if your application information.

It reduces the home’s assessed value of property taxes by $50,000, so a home that is worth $500,000 would be taxed. Filing for the homestead exemption can be done online. Documents should reflect the address of your homesteaded property.

Social security numbers for your spouse and any owner who resides on the property. Homestead exemption provides a tax exemption up to $50,000 for persons who are permanent residents of the state. 2300 virginia ave #107, fort pierce, fl 34982 email :

When someone owns property and makes it his or her permanent residence or the permanent. Initial application for homestead exemption and other exemptions must be made at the property appraiser's office by march 1st of the year you are applying for. What you need to apply.

You are now exiting the sarasota county, fl. The property on which you wish to apply for homestead exemption must be your primary place of residence on january 1 of the year for which you are making an. There are two ways to apply, depending on certain criteria.