Heartwarming Tips About How To Handle Bounced Checks

If you can’t reach the customer by phone, you can try sending a bounced check letter to customer.

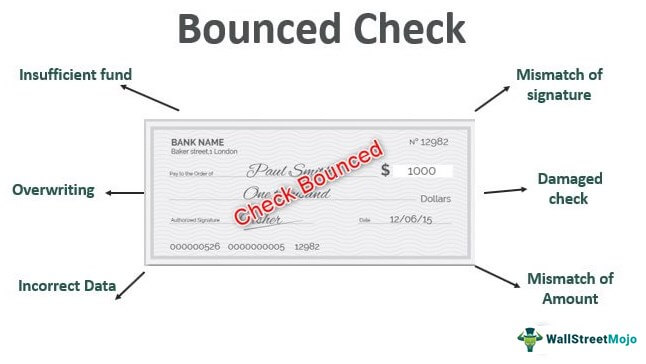

How to handle bounced checks. If funds aren't added within a few days, the check likely bounced. In the income account field, choose your bank. Follow the method that works best for you.

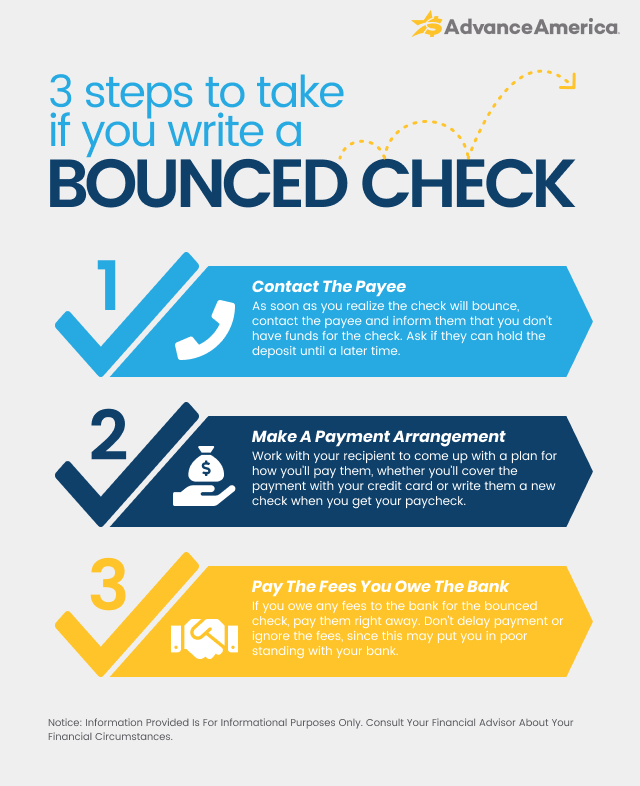

Contact the party to whom you wrote the check. Check the journal entry created in step 1. After you realize that you’ve bounced a check, use these steps to get things sorted:

Once you realize you’ve bounced a check, immediately contact the bank, company or. To record bounced checks in quickbooks desktop pro, open the “receive payments” window. Enter a memo to indicate the check was returned for nsf.

Let the recipient know immediately that you’re aware your check bounced. Ask almost any credit card processing company about its check service programs, which set you up with a. Make sure you serve the notice within twelve hours of the time you received notification.

How to record a bounced check. But to foil the occasional rubber check writer, there is a simpler way: If you bounce a check.

Here’s what you should do: Select the name of the customer who issued the bounced check to open the transaction list. Locate and select the bounced check.