Favorite Tips About How To Fix Credit After Bankruptcy

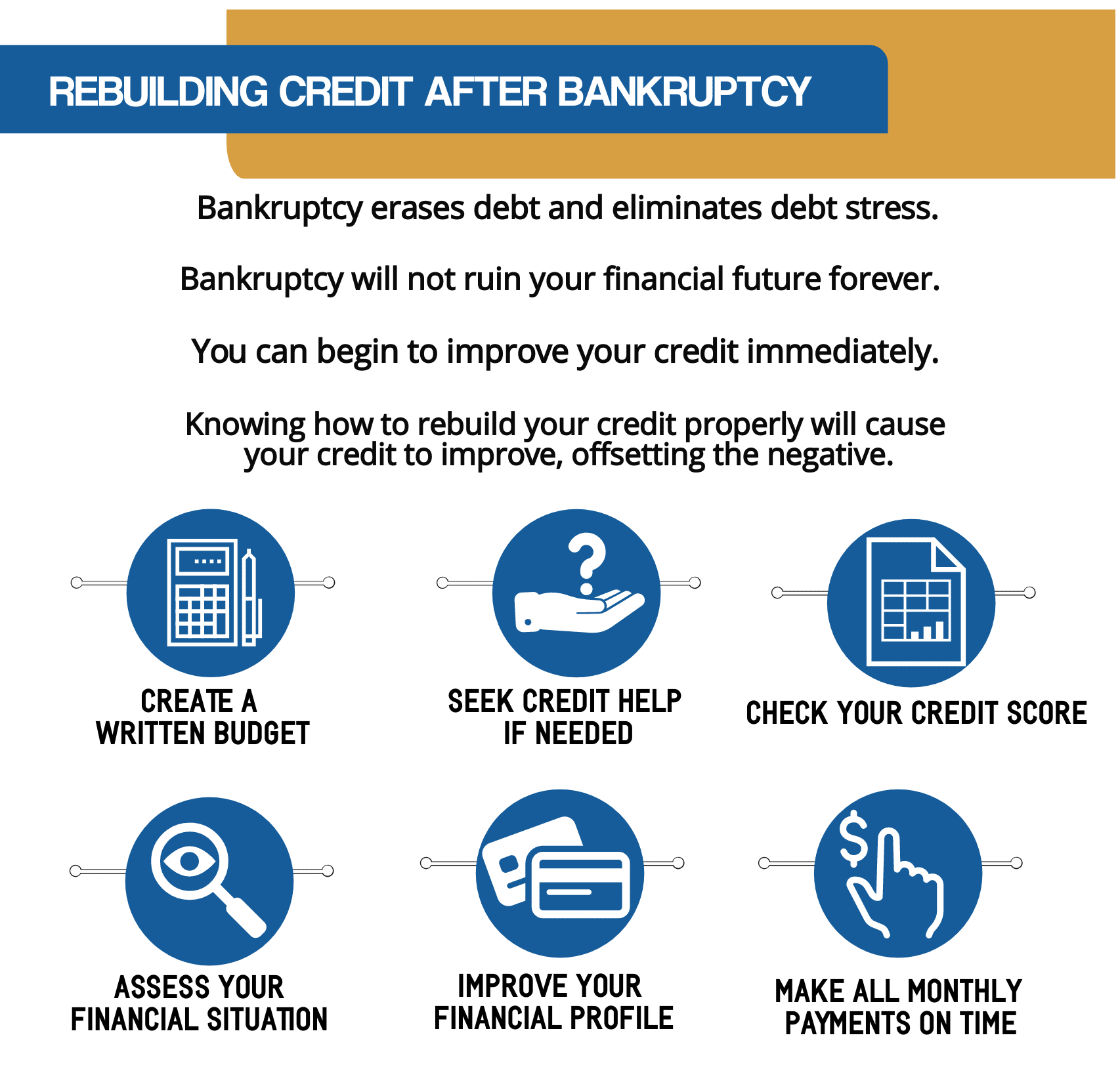

When you’re trying to build your credit after bankruptcy, here are some types of credit for you to consider:

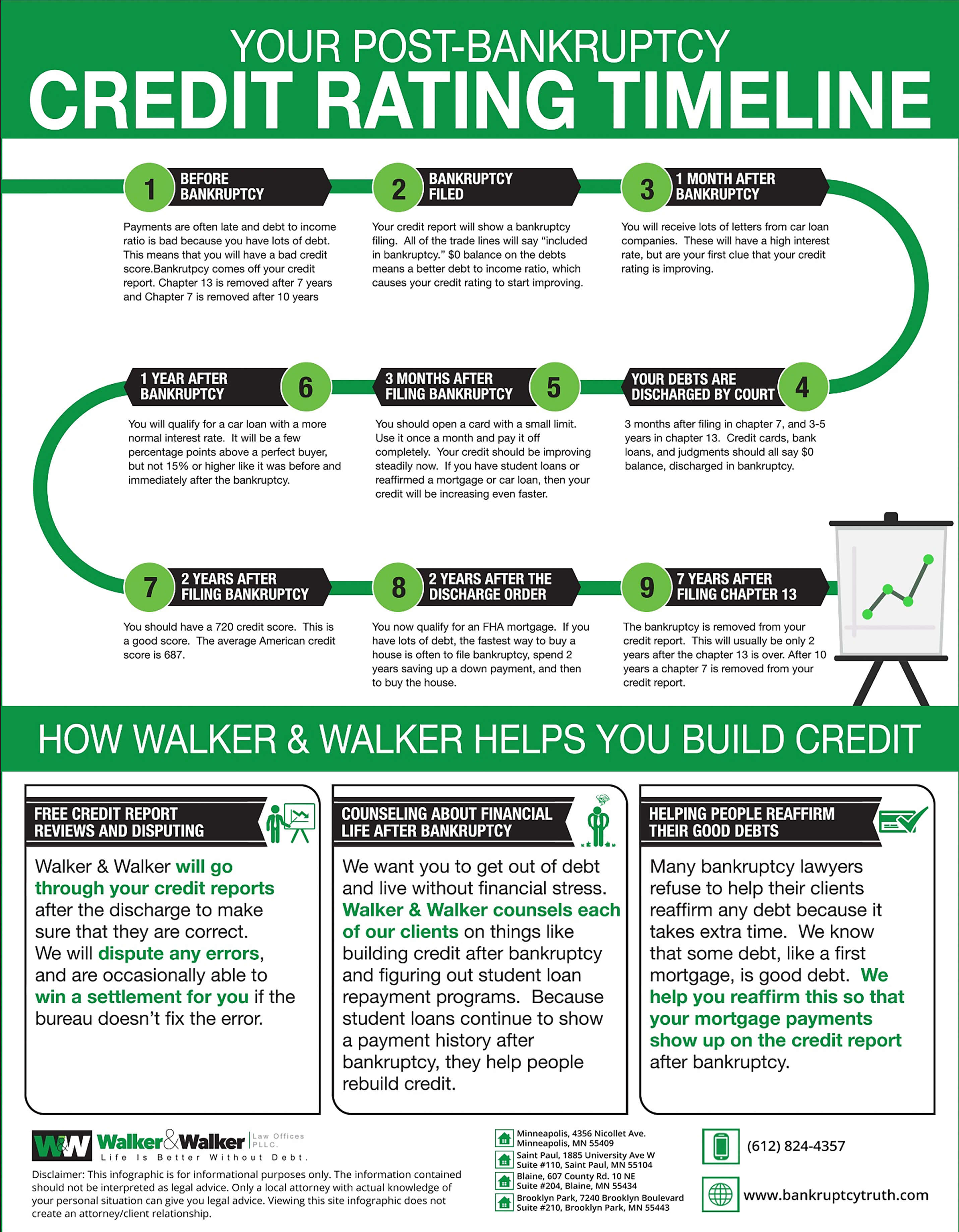

How to fix credit after bankruptcy. After you file bankruptcy, determine which accounts were not closed. Immediately after filing bankruptcy, you will begin to. With a credit builder loan, you deposit money.

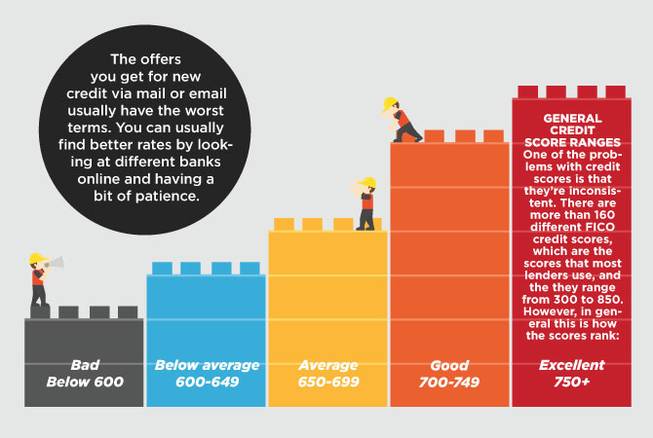

Ad you can increase your fico® score for free. New credit scores take effect immediately. Rebuilding credit after chapter 7, credit repair after.

Apply for a secured credit card. Here are just a few tips to boost your credit score after filing: After a bankruptcy, it may be difficult.

It’s a good idea to take on some reasonable credit after bankruptcy to start a positive repayment history, increase your credit variety, and show future lenders that you’re. You can start rebuilding your credit score after the bankruptcy stay stops creditors from taking action. After bankruptcy credit repair, how long after bankruptcy does credit improve, building credit after bankruptcy, getting credit after bankruptcy, after bankruptcy credit card, best credit card.

Make your payments on time so that you. Reduce debt by up to 50%. Ad one low monthly payment.

While bankruptcy will definitely hurt your credit score, there are some things you can do to start rebuilding your credit once the bankruptcy is discharged. Secured cards will start off with low balances of $200 or $300 to help you begin to improve your credit. You should monitor your credit for a number of reasons, but especially if you recently filed for bankruptcy.