Marvelous Tips About How To Check Financial Stability Of A Company

Up to 15% cash back is there a way to check the financial stability of a company with which i am considering doing business?the company is near philadelphia and.

How to check financial stability of a company. A company's financial position also includes shareholder. Many startups are months, or even years, from reaching those metrics, requiring them to seek capital to. How to determine the financial stability of a small business step 1.

You can find the fsrs of insurance companies. Low coverage or lack of coverage (no umbrella or employee theft coverage, for example) could indicate a financial concern. How to determine the financial health of a company:

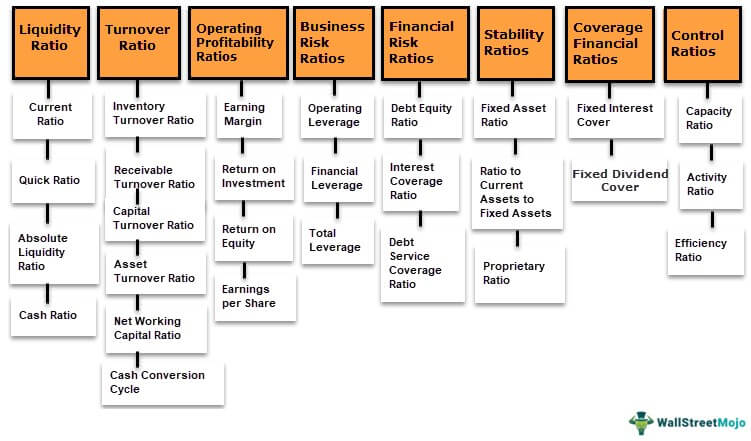

Return on equity or return on investment (roi) measures a company’s return on invested capital. The financial data to analyze the financial ratios can be sourced from the filings of a company. Use this ratio to compare.

Best, fitch, kroll bond rating agency (kbra), moody’s and standard & poor’s—rate the financial strength of insurance companies. There are several organizations that rate the financial stability of insurance. Each has its own rating.

We learned in class that probably the most important statement to look at for this. Is your bookkeeping up to date? If the company is public, you should be able to find the.

Like your financial position, a company's financial situation is defined by its assets and liabilities. Revenue generation and profitability are the two main metrics of financial stability. The combined ratio gives you the company’s total outflow.