Cool Tips About How To Check A Vat Registration Number

Calling the hmrc vat helpline.

How to check a vat registration number. In the second field, enter. Hmrc has a complete database of vat. Consequently, where vendors are newly.

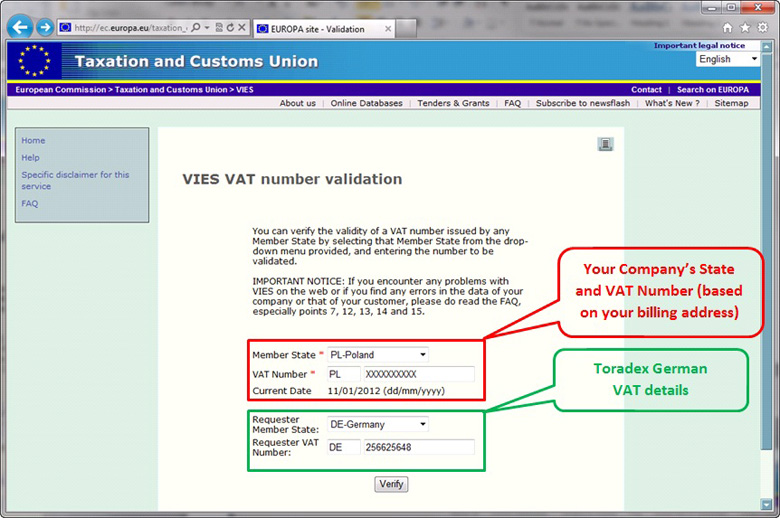

How do i check an eu vat number? Checking the validity of vat registration number. 1) apply for a tax identification number (tin) in your country of residence by submitting documentation and waiting for approval;

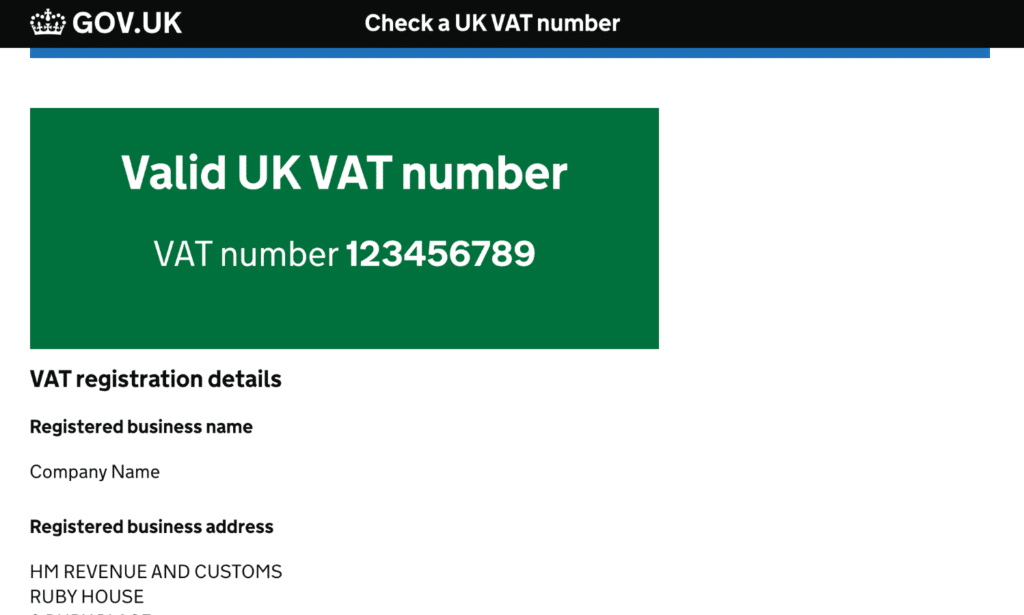

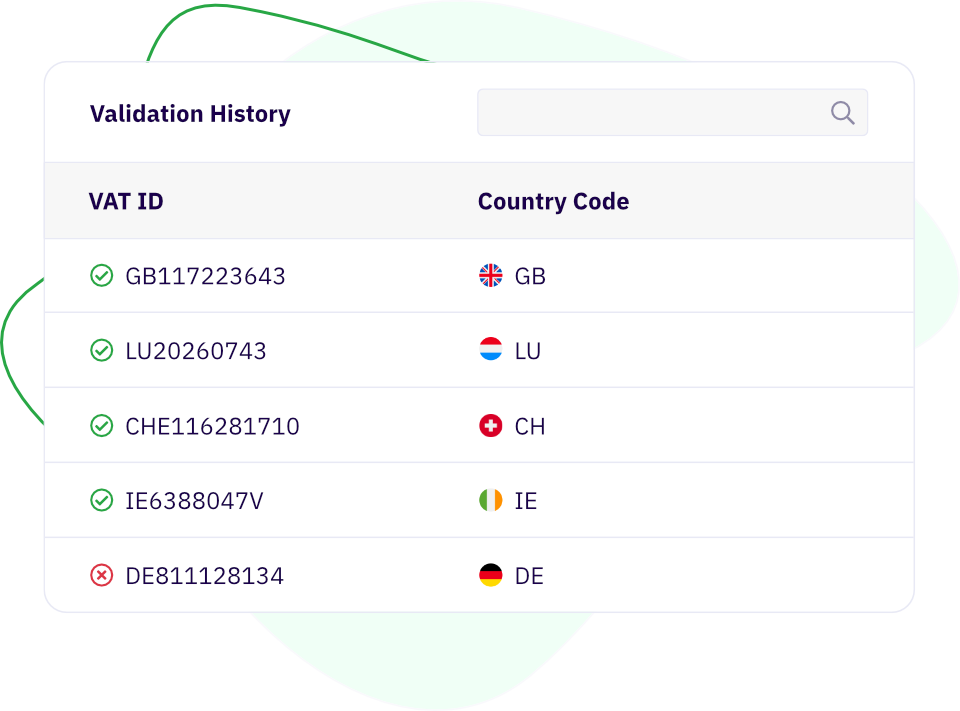

If you want to verify the validity of your client's vat identification number, you can use the european commission's vies vat number validation (vat information exchange system,. It is difficult for a company to know if their business counterpart’s vat registration number (vrn) is legitimate or not. Call the hmrc vat helpline on 0300 200 3700.

In the first field, choose the origin country of the business in question. There are a couple of ways to check that a vat registration number is valid: Calling the hmrc vat helpline.

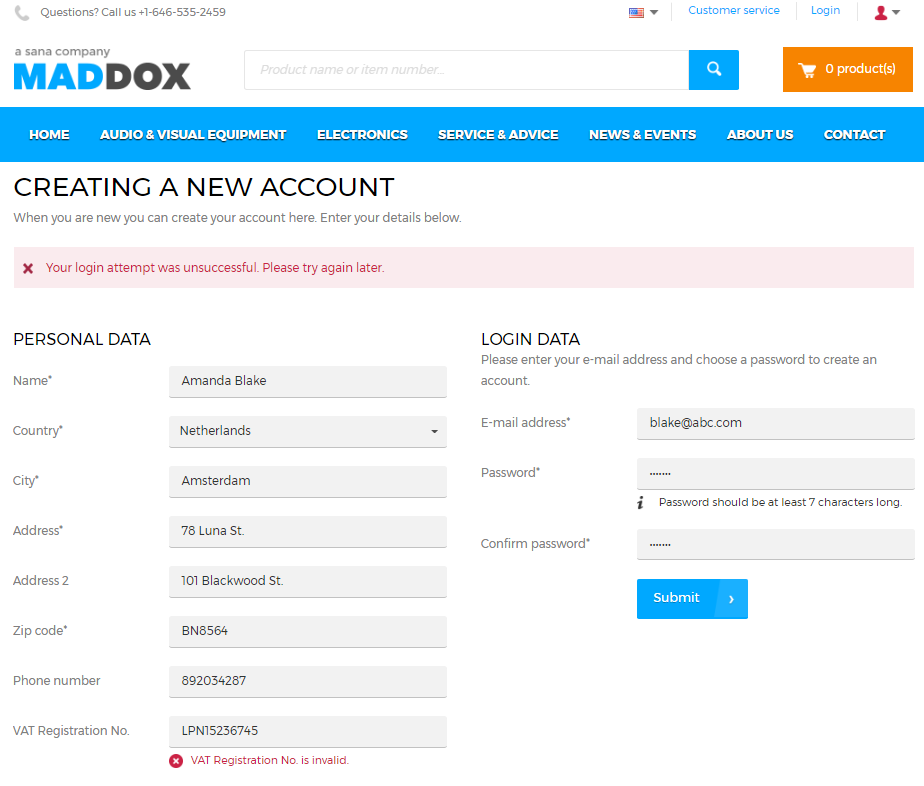

You can view the vat registration log on the customer, vendor, or. Users must please note that the database is updated weekly. When you verify a vat number, the request identifier column in the log will reflect that you have taken action.

If you experiencing problems finding the correct vat registration. If a uk vat registration number is valid. You can find the vat number on the issued invoice, official credentials, national tax office page and check on our vat registration number check system or vies.

![Vat Number Checker: Eu, Norway, Switzerland, Thailand [Free]](https://vatapp.net/img/info.png)