First Class Info About How To Buy A Reit

First of all, your investment is liquid.

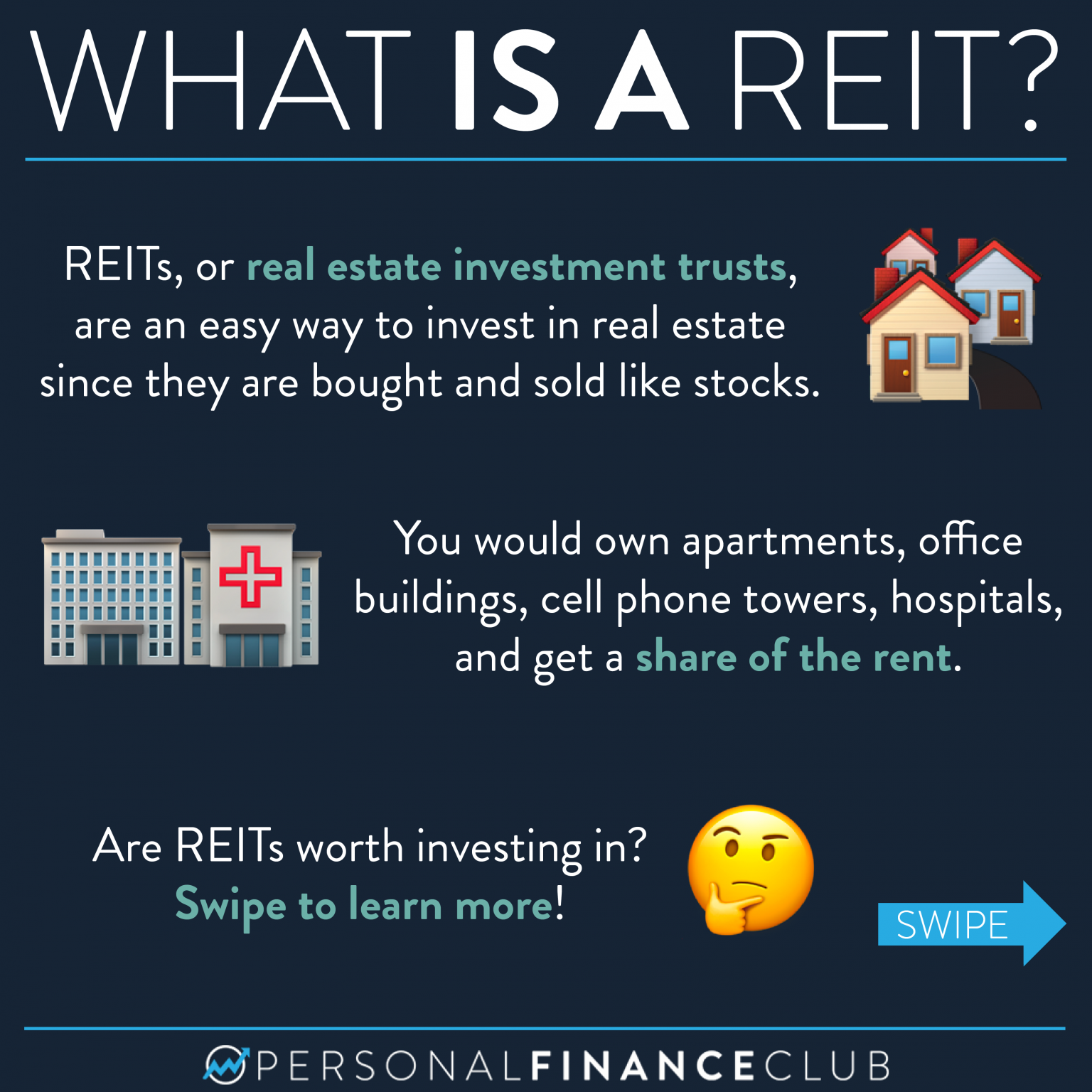

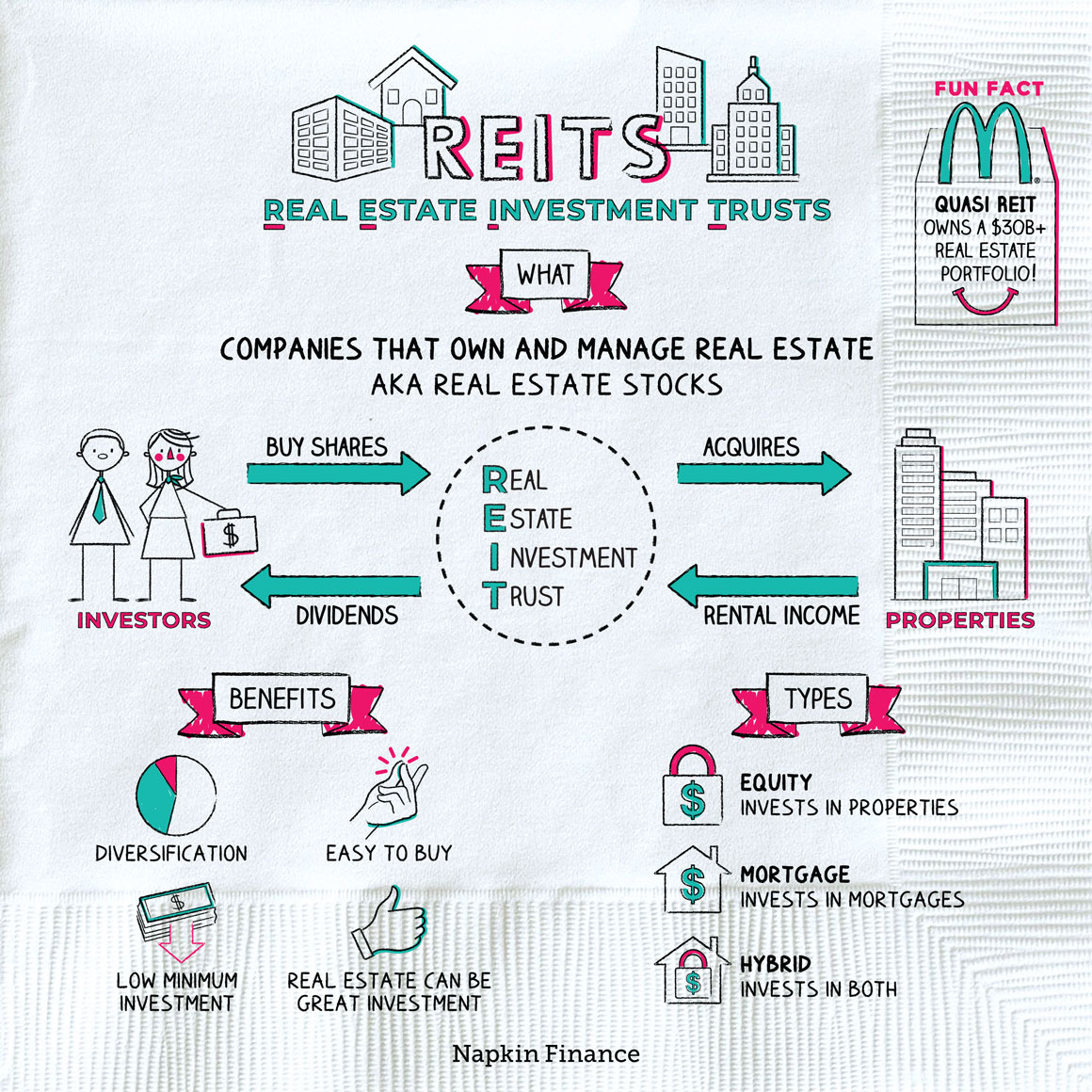

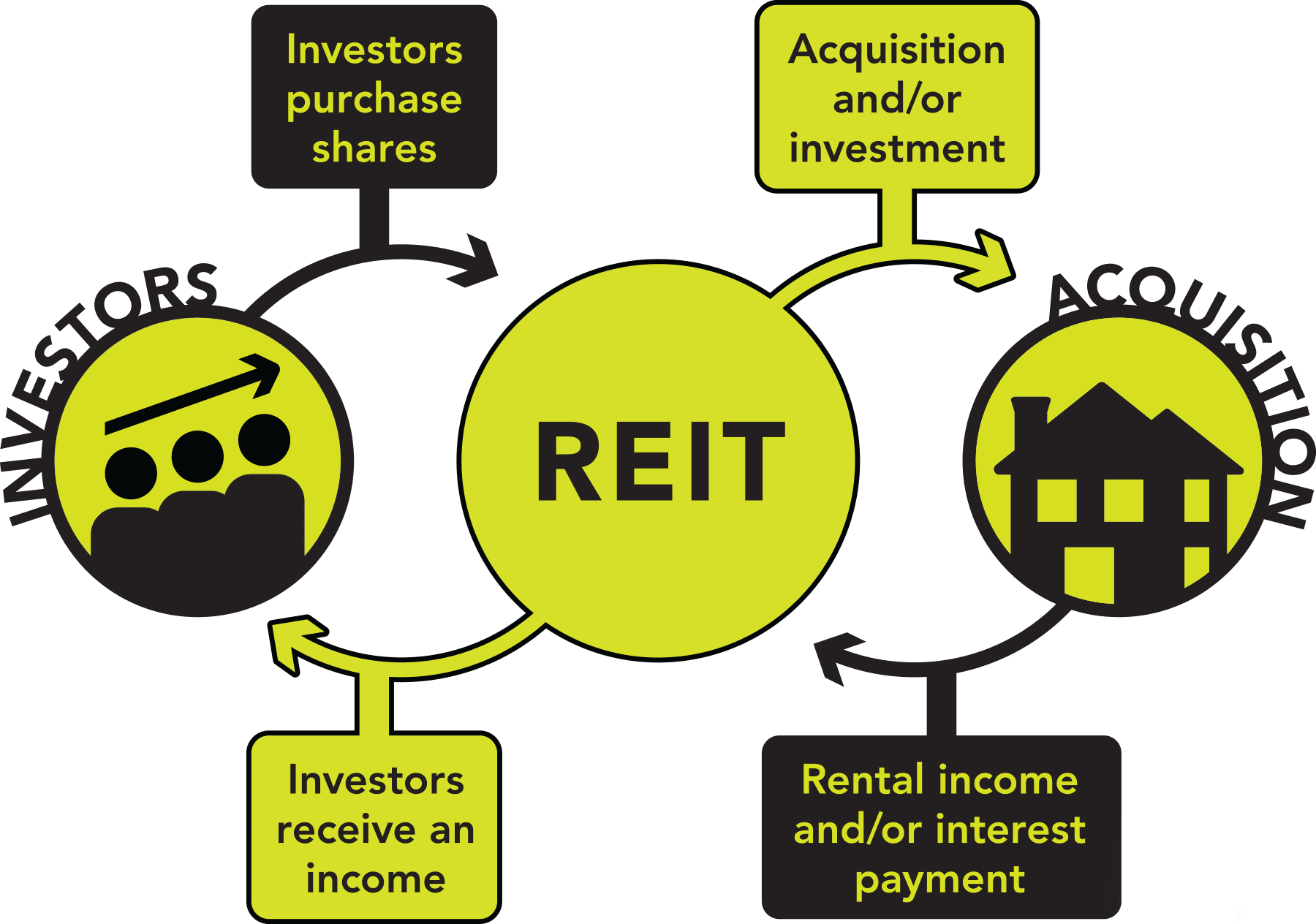

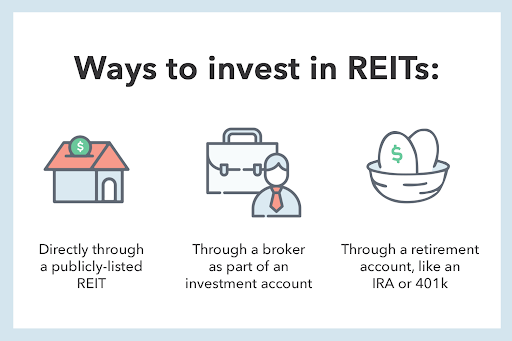

How to buy a reit. Shares of reits have low investment minimums, as well;. Decide what type of reit you want to form form a taxable entity. Open an account in minutes.

Assess the reits performance to decide whether to buy or sell;. I recommend three brokerage accounts that are. “we are impartial, we don’t say that we have to buy from our.

This time shouldn't be different and therefore, the time to buy is now. Search for the reit you want to trade in our platform; Open a brokerage account and buy your first reit here's the final step.

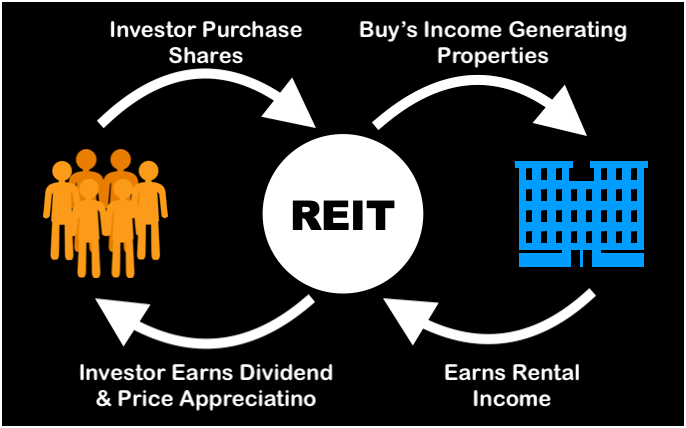

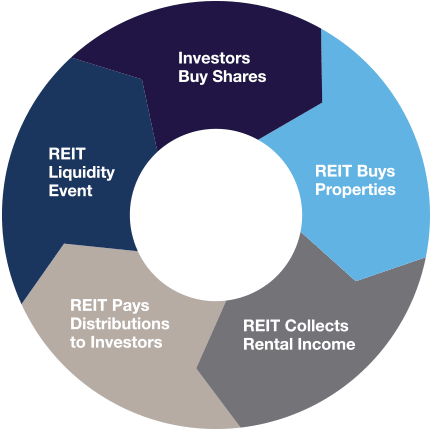

We cannot predict tomorrow, but we know that those who have the courage and patience will be. You, along with any partners, must first create a corporation that will later become the reit. Insulate your portfolio from inflation by investing in commercial real estate trusts.

Simply just search for the stock code on the platform,. Ad earn better than average returns with a top performing reit. And you don’t need to invest a large.

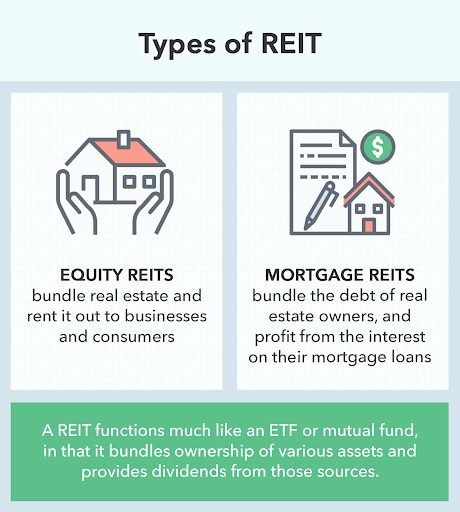

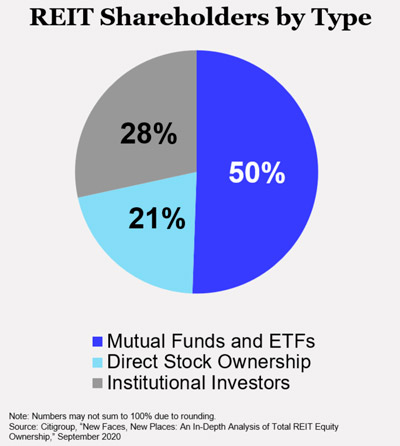

This is a big draw for investor interest in reits. Return a minimum of 90% of taxable income in the form of shareholder dividends each year. It invests in real estate properties across 8 sectors and.