Underrated Ideas Of Tips About How To Build Credit In Canada

Keep old credit alive 5.

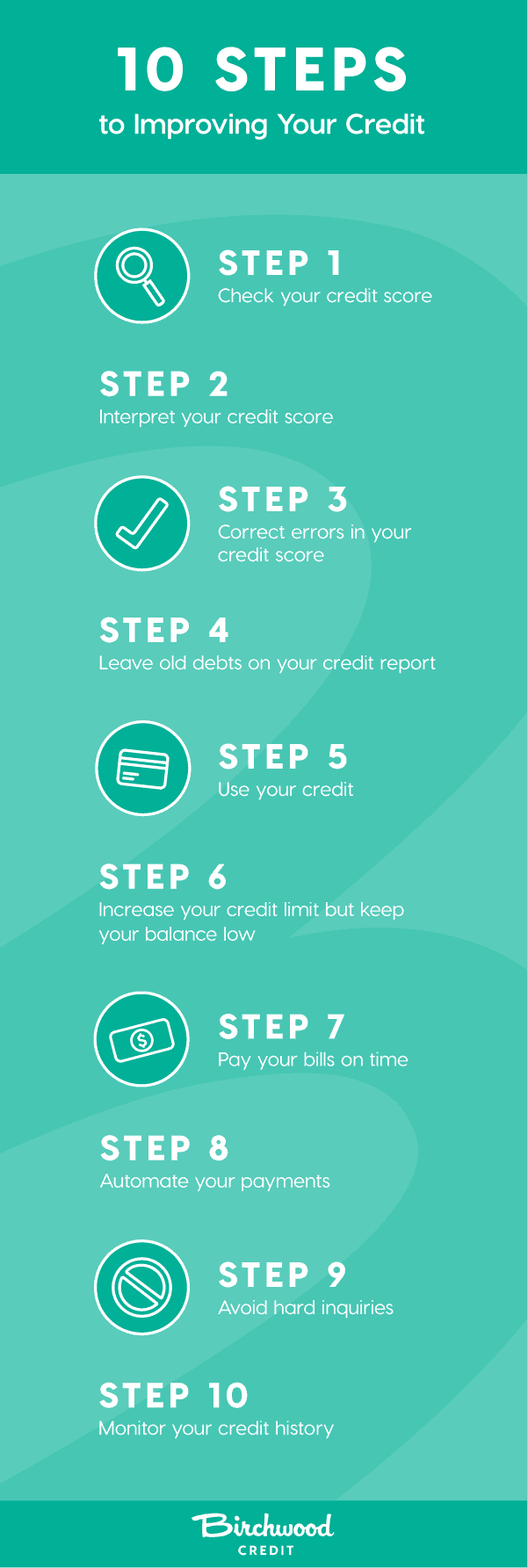

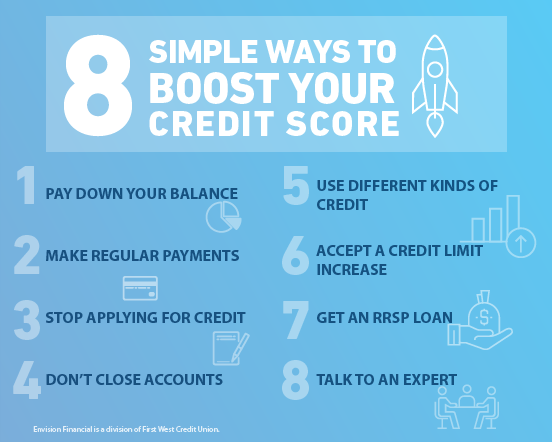

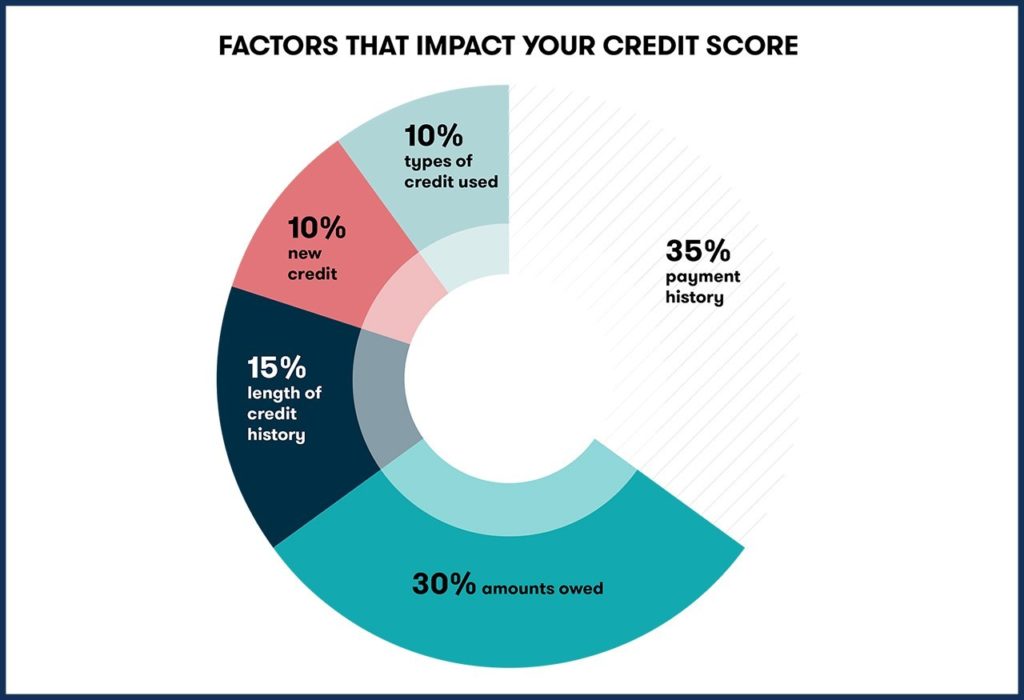

How to build credit in canada. Use credit wisely increase the length of your credit history limit your number of credit applications or credit checks use different types of credit monitor your payment history your. If you want to know how to rebuild your credit, here are five steps you can start taking. Inspect your credit report and score 2.

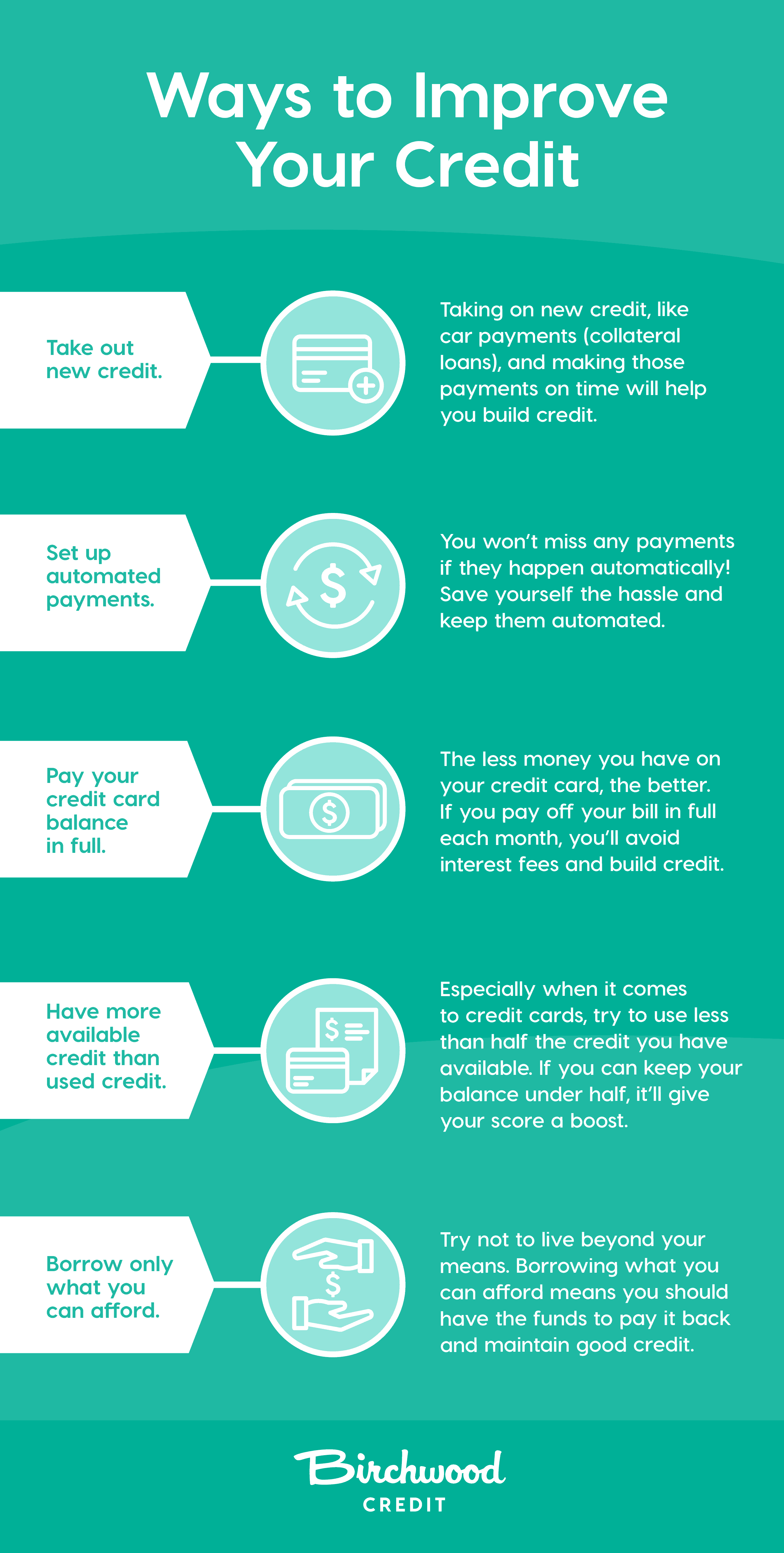

These programs offer debt relief. Bank accounts that allow you to apply for mortgages to purchase property in. To help boost your credit score, one of the best things you can do is to manage your spending.

The lendle secured credit card is a unique card that offers a number of benefits from cash back to better credit. Another option is to apply for a retail credit card. Having a canadian credit card and making regular payments on it is the easiest way to establish a credit history and build a good credit score in canada, which can help you qualify for other.

A retail credit card is similar to a traditional credit card, except it’s offered by your favourite retailer. Most of the large banks in canada offer free credit scores to their customers. Lendle secured credit card perks.

The trickiest one is when it is your first time applying for a loan or credit card. It is important here to build a. Since your credit score is 0 it is tough for the person to access your capabilities.

Check your credit report the first step in repairing your credit is determining which areas need. This leads to more debt,. To find the best option, ask your local bank what packages they offer for globally minded citizens.