Unbelievable Tips About How To Become Tax Exempt In Texas

![Texas Sales Tax Exemption Certificate From The Texas Human Rights Foundation] - Unt Digital Library](https://www.pdffiller.com/preview/31/836/31836164/large.png)

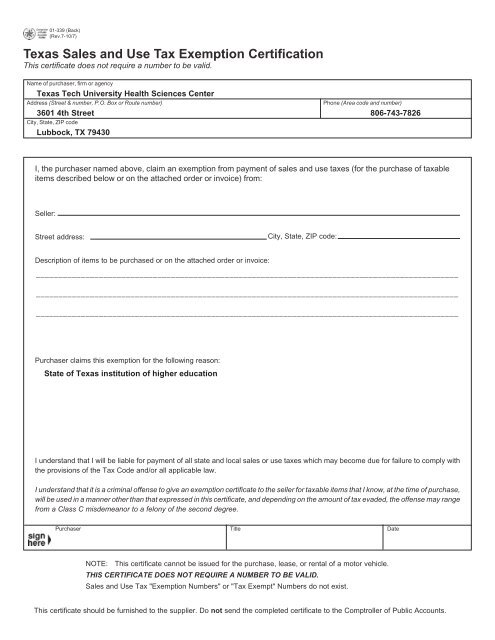

A qualifying 501(c) must apply for state tax exemption.

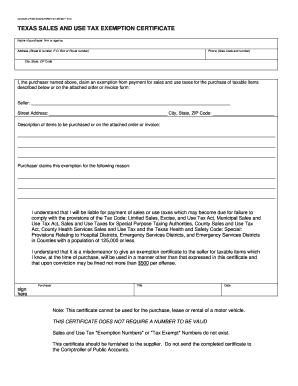

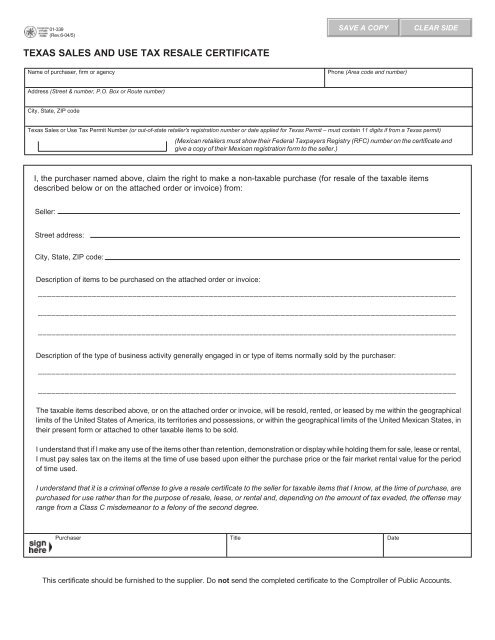

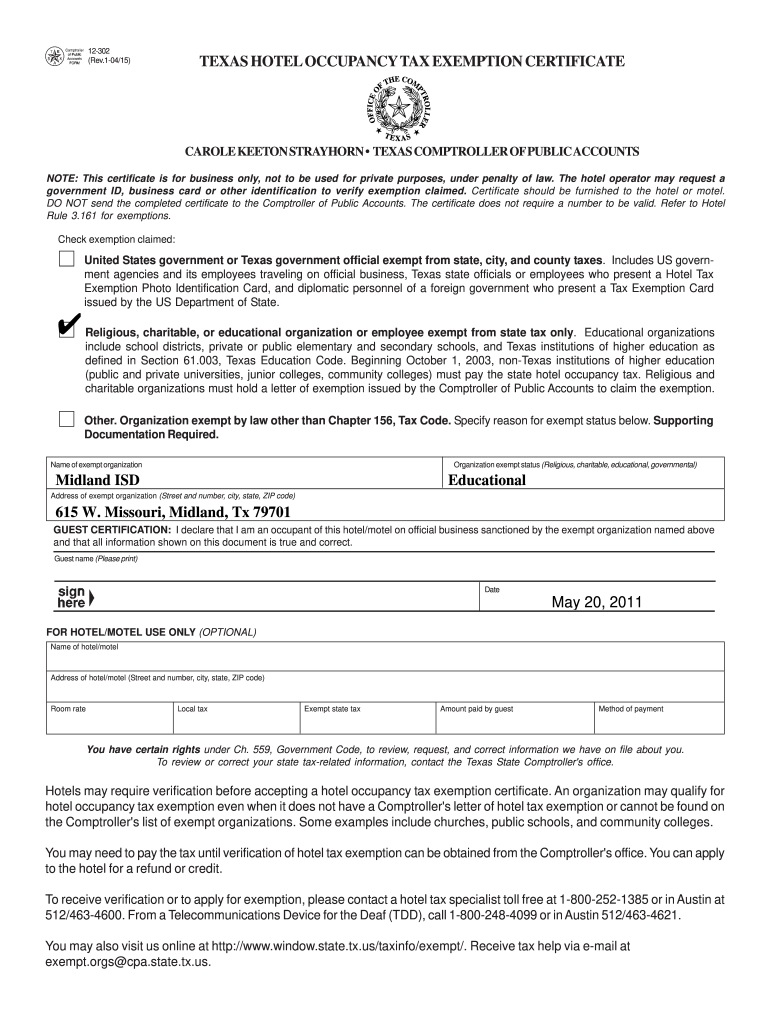

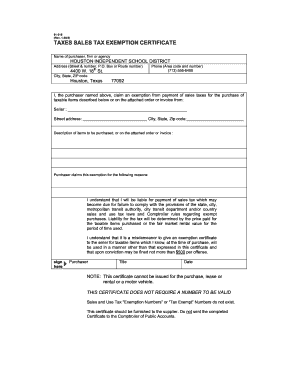

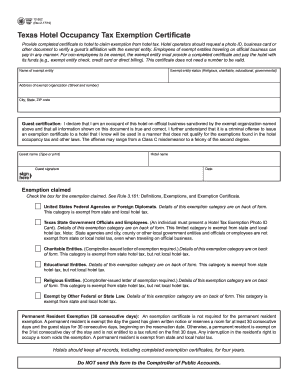

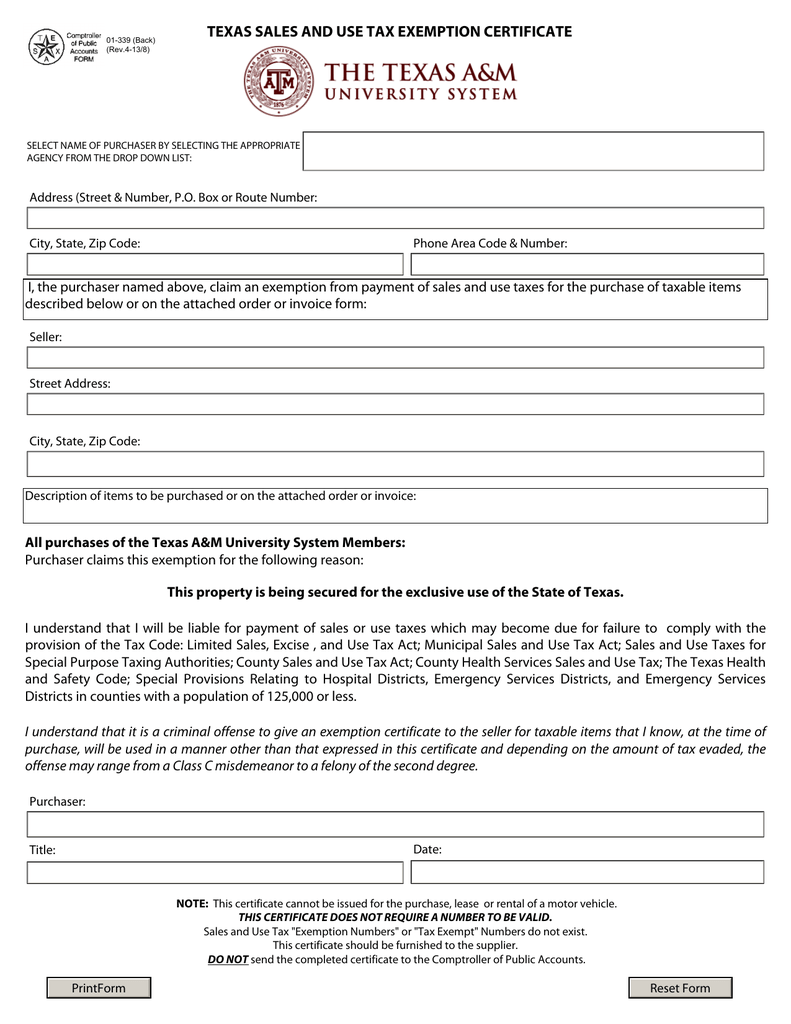

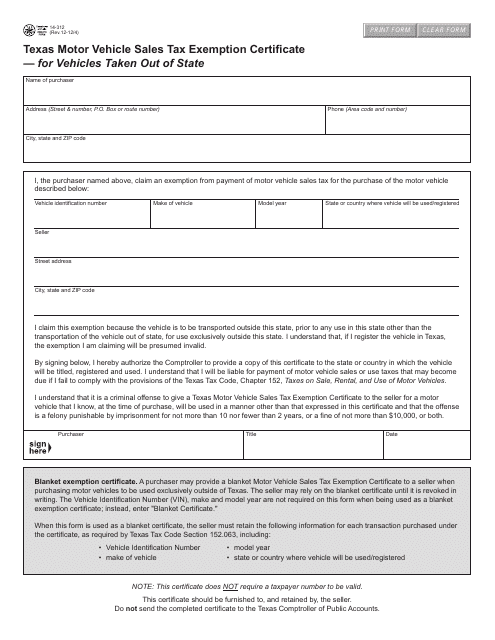

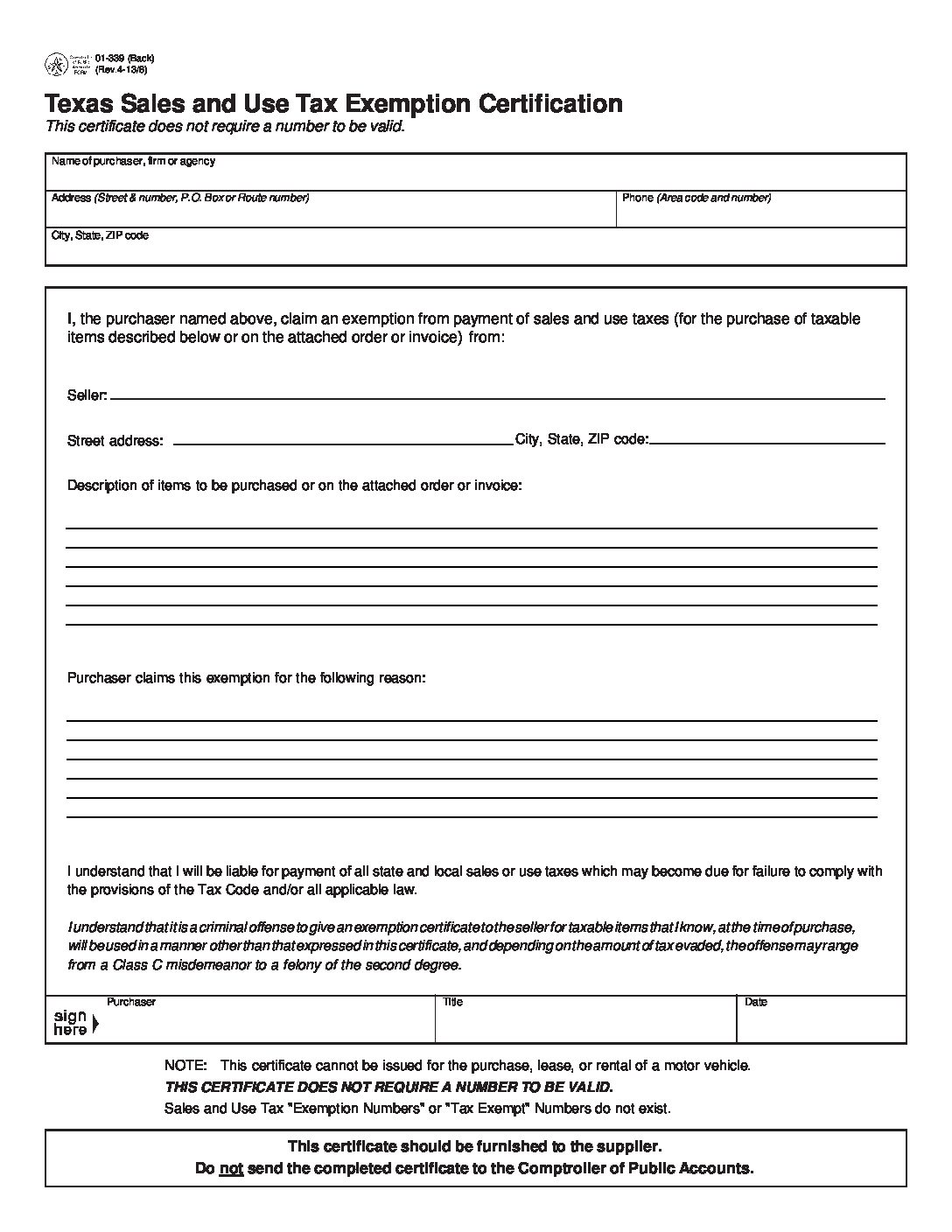

How to become tax exempt in texas. As of january 31, 2020,. Certain organizations can apply to our office for exemption from franchise tax, from sales taxes on purchases necessary to the organization's exempt purpose, or from hotel tax when traveling. The provisions of the tax code and/or all applicable law.

Sales and use tax exemption certificates. To qualify as exempt from federal income tax, an organization must meet requirements set forth in the internal revenue code. To become exempt from this type of tax in texas, an hoa must prove three central items.

How do we apply for an exemption? In some states, your organization is not automatically exempt from state sales tax, even after obtaining 501 (c) (3) recognition from the irs. I understand that it is a criminal offense to give an exemption certificate to the seller for taxable items that i know, at the time of.

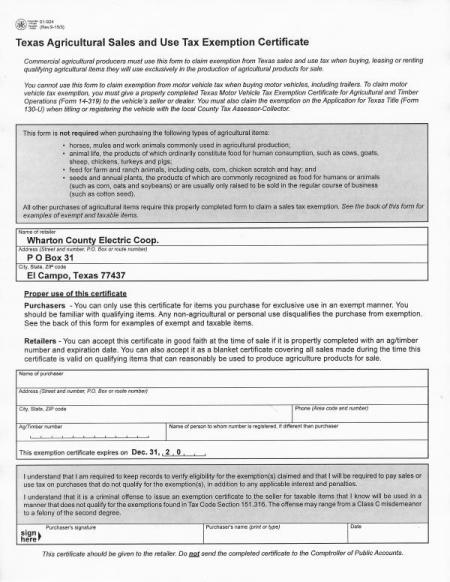

To claim a tax exemption on qualifying items, you must apply for an agricultural and timber registration number (ag/timber number) from the comptroller. The texas tax code provides an exemption from franchise tax and sales tax to: The general deadline for filing an exemption application is before may 1.

Nonprofit organizations with an exemption from internal revenue service (irs) under irc section 501(c). Applying for tax exempt status. Applications for property tax exemptions are filed with the appraisal district in which the property is located.

Texas sales tax exemption for a nonprofit. Texas state law permits 501 (c) (3). First, your hoa must be a nonprofit with the main purpose of managing residential property.