Favorite Info About How To Avoid The Seven Pitfalls Of Basel Ii Operational Risk

The rush to reach basel ii compliance can present an assortment of roadblocks and hurdles for investment banks, but they don’t have to stall your schedule.

How to avoid the seven pitfalls of basel ii operational risk. ‹ map to the seven. ‹ refer to relevant external loss data to understand industry experience with respect to large losses. The book explains why and how.

Operational risk loss data ‹ collect internal operational loss data. The operational risk requirements of basel ii (international convergence of capital measurement and capital standards) place a heavy emphasis on the identification, assessment, monitoring. Basel ii provides 7 categories of level 1 loss events that most firms have adopted to meet their own operational risk (oprisk) framework requirements.

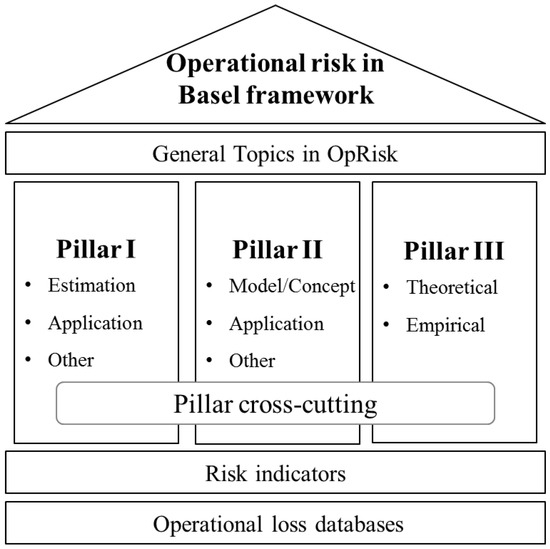

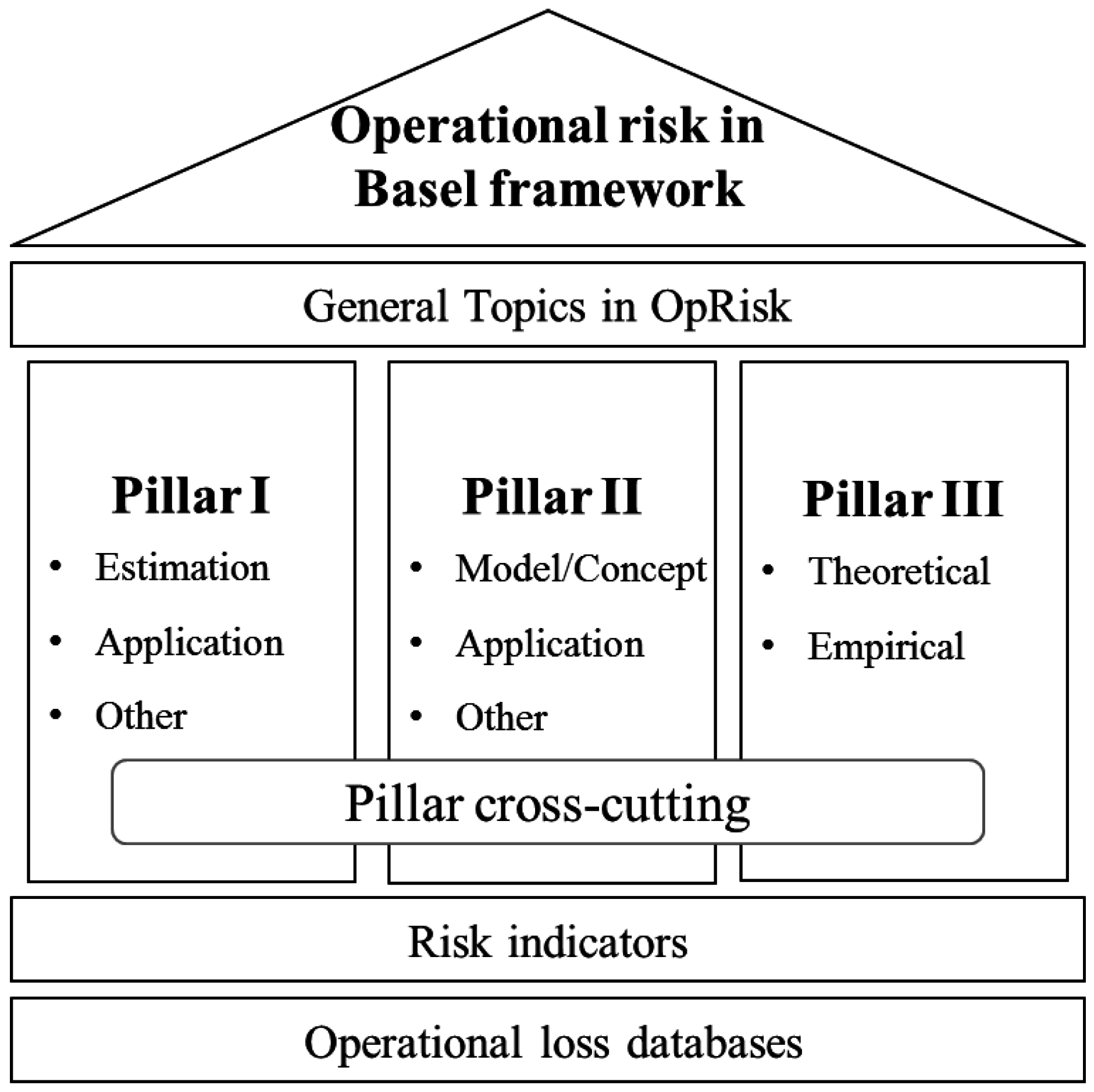

Basel ii has projected seven types of operational risks that banks and financial institutions should bring into focus: The basel committee has identified three approaches to setting capital charges for operational risk: In the first article of the series, we made several important steps towards understanding operational risk in practical terms.

Based on a study performed by the european banking authority 4, it is estimated that the implementation of basel iii will result in an increase of 23.6% in the minimum required. Operational risk control with basel ii, provides a sound methodology for operational risk control and focuses on management risk and ways to avoid it. (1) the basic indicator approach, (2) the standardized approach and (3).

This is the reason why every organization tries to align its risk management. A second key feature of the basel ii accord for operational risk is the need to start building statistical models of the operational risk profile the bank is incurring. The basel guidelines are the gold standard when it comes to identifying and managing operational risks.

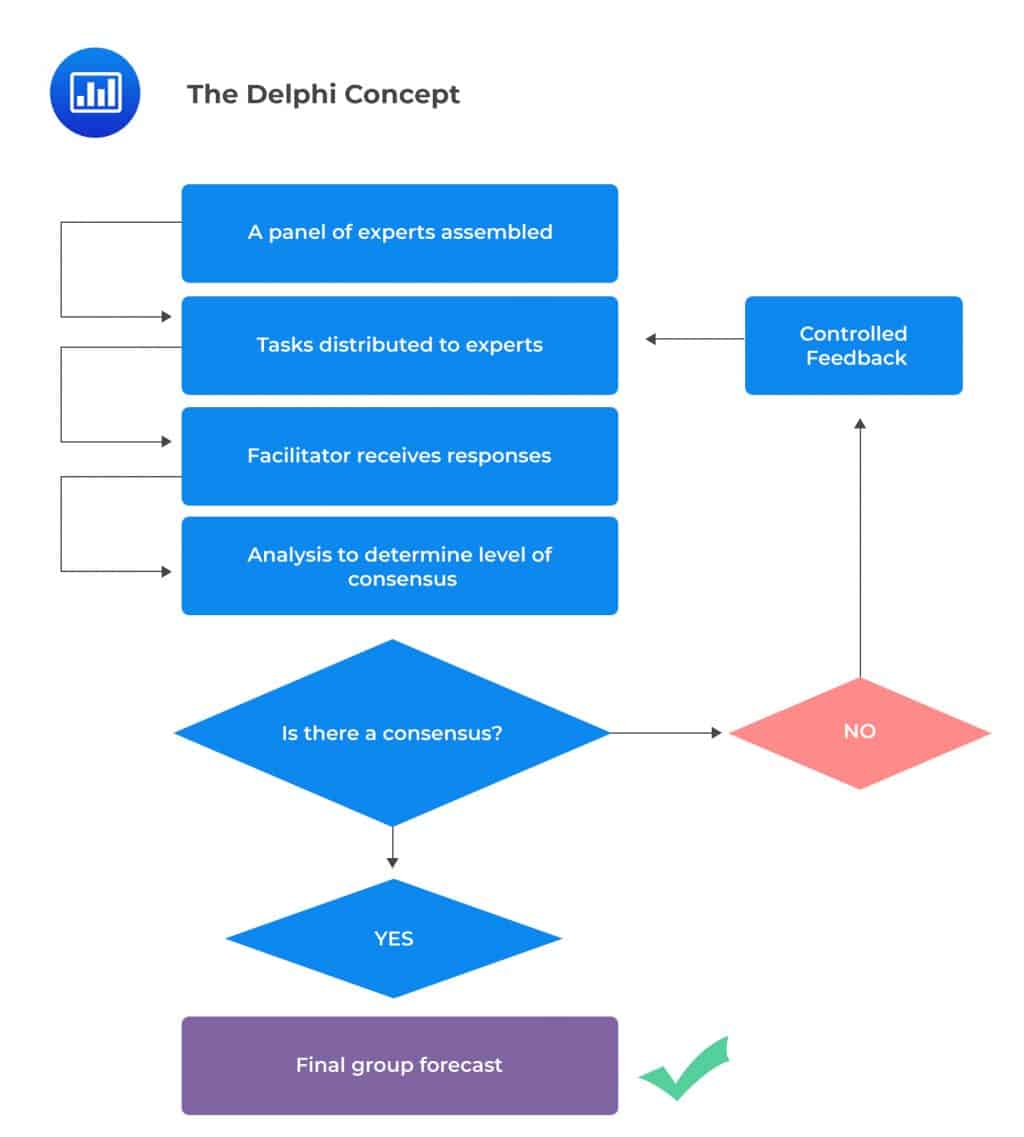

Avoiding the seven pitfalls in basel ii operational risk implemetationbasel ii calls for institutions to employ more advanced approaches to operational risk identification,. Operational risk control with basel ii, provides a sound methodology for operational risk control and focuses on management risk and ways to avoid it. One way to avoid this happening is to introduce the idea of modelling correlations between credit risk and market risk and eventually also operational risk.

:max_bytes(150000):strip_icc()/BaselIIAccordGuardsAgainstFinancialShocks1-fb23a015d23643009e189c8f43c74a03.png)

:max_bytes(150000):strip_icc()/BaselIIAccordGuardsAgainstFinancialShocks2_2-e24c7d4ba1f140128a1237b6a82efb40.png)